Forget Raising Rates, Shrink the Balance Sheet

Content

Find out how the Cleveland Fed supervises and regulates member banks to ensure financial-system stability and support the US Treasury. Understand the various requirements Shrinking The Feds Balance Sheet for Fed-chartered financial institutions and discover the range of services available to them—from cash services and reserve balance data to the discount window.

What does Fed balance sheet reduction mean?

The Fed balance sheet reduction means that the American financial system is undergoing the process known as quantitative tightening. Under the process, the interest rates hike to tighten the money flow into the system through lesser credit approvals.

He said the Treasurys would only remain on the Fed’s balance sheet temporarily. He assured Congress that https://business-accounting.net/ once the crisis was over, the Federal Reserve would sell the bonds it bought during the emergency.

Shrinking the Fed’s balance sheet is not likely to be a benign process, new Jackson Hole study warns

Additionally, an ever-increasing balance sheet would expose the Fed to even larger losses in a tightening cycle. Given the uncertainties surrounding the effects of QT and the potential for market disruptions as the Fed tries to zero in on the right level of reserves, why shrink the balance sheet at all? Most policymakers and economists expect that QT will provide some additional monetary tightening, which should help the Fed achieve its goal of getting inflation back down to its 2 percent target.

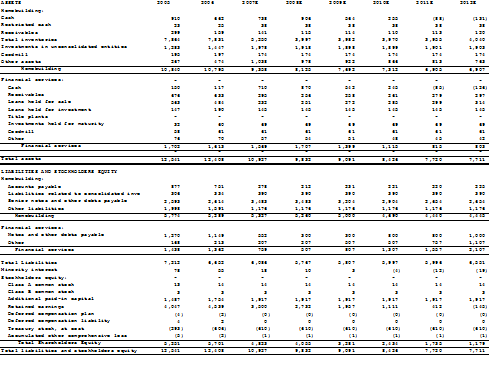

The Fed plans to reduce its $8.5 trillion balance sheet beginning June 1, when it will no longer reinvest proceeds of up to $30 billion in maturing Treasury securities and up to $17.5 billion in maturing agency mortgage-backed securities per month. Beginning September 1, those caps will rise to $60 billion and $35 billion, respectively, for a maximum potential monthly balance sheet roll-off of $95 billion. Fixed‑income securities are subject to credit risk, liquidity risk, call risk, and interest-rate risk.

Free Tools

However, because the Fed has developed other tools for removing policy accommodation without asset sales, the pace at which the balance sheet will return to its normal configuration will depend on the sequence of policy actions. That sequence will largely be determined by the perceptions of FOMC participants about the likely evolution of economic and financial market conditions, and on the resilience of the housing sector. The stronger the economy and the stronger the housing sector in particular, the sooner asset sales would likely commence.

- The Fed’s balance sheet is significantly larger this time relative to what would be considered an optimal range to effectively implement monetary policy.

- This is a big problem for a US government already over $31 trillion in debt.

- The Fed had already returned to quantitative easing before the coronavirus, and the balance sheet was back above $4 trillion in October 2019.

- We help ensure our financial system is operating safely and effectively, and we help support secure and efficient methods to transfer your funds through our financial system.

- There’s much to learn about the balance sheet’s effects on the economy, said Megan Greene, global chief economist at the Kroll Institute and a senior fellow at Brown University.